You are sitting with your laptop open on a late-night caffeine high, polishing your pitch deck for the tenth time. You tweak the problem slide, add a market stat… and then the worry hits you:

“Is my product actually investor-ready?”

Because this is the truth, first-time founders often learn the hard way: Investors don’t fund ideas. They don’t fund pitch decks. They fund traction, clarity, and a strong investor-ready MVP that proves you can execute.

Even pre-seed investors want something real, not perfect, not complete, but validated enough to show direction, risk reduction, and demand.

In this blog, we break down the product qualities that make investors say YES when you are raising your first round. This is your roadmap for building an investor-ready MVP and a pitch-ready startup that stands out in the seed stage.

Why Should Investors Care About MVP Quality More Than Deck Design?

Seed investors are not evaluating your app UI. They are evaluating your execution logic.

Even something as small as 20 genuinely engaged users tells them more about your potential than the best-designed deck ever could. It shows you’ve tested your assumptions, solved a real problem for real people, and taken the first steps toward traction.

A strong MVP for fundraising sends a message: “You don’t just have ideas. You build.”

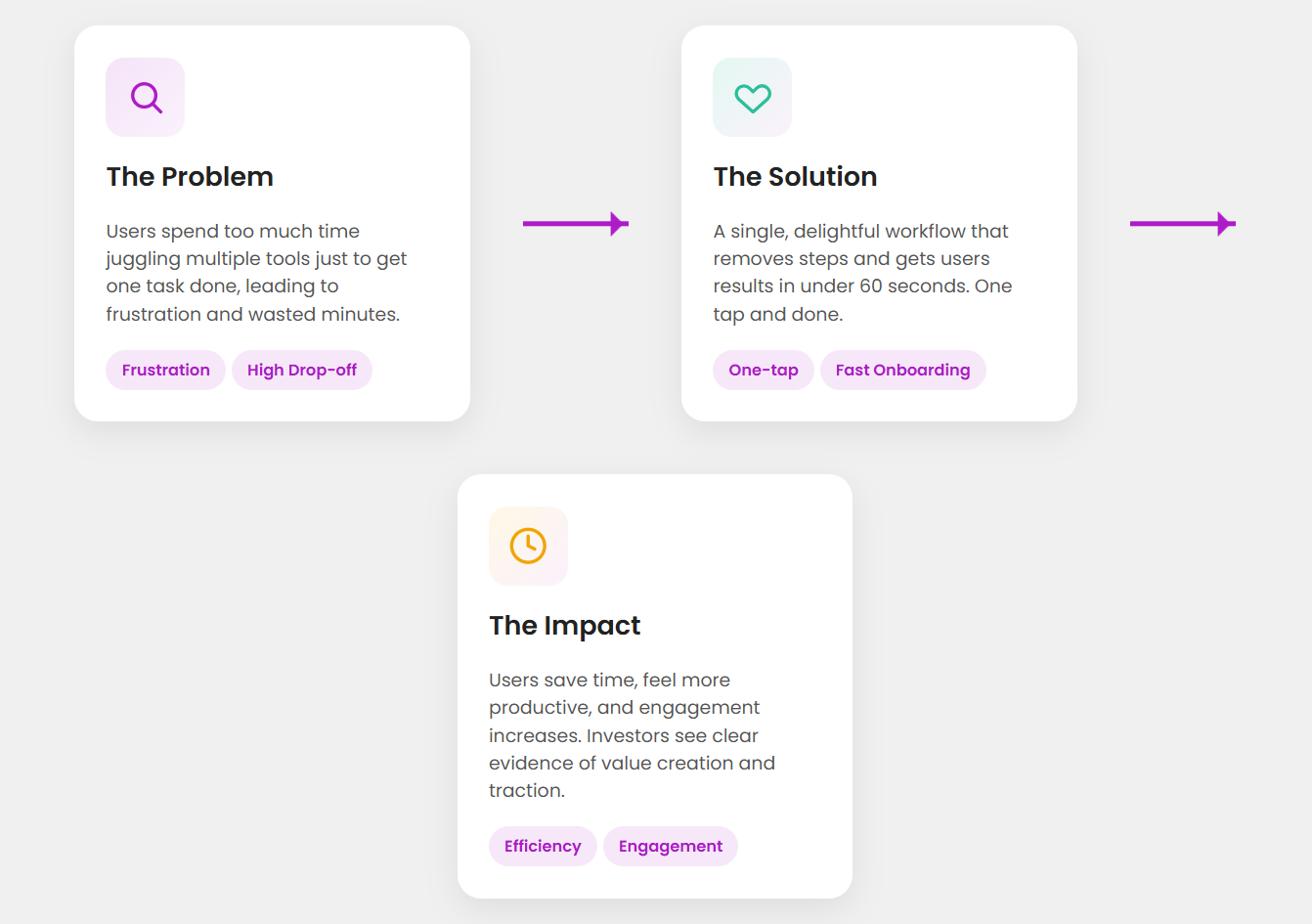

1. A Clear Problem-Solution Fit (Investors Need to See Pain)

Every great startup begins with one thing: paint clarity.

Founders often pitch with excitement:

“We are building a next-gen AI-powered platform for XYZ.”

Investors don’t care about AI. They care about pain points and behavior patterns. A good investor-ready MVP focuses on the core pain, not fancy features. Investors are actually looking for:

- A clearly defined user persona

- A real problem that occurs frequently

- Evidence that users are seeking alternatives today

- Your solution solves the pain in a simpler, faster, or cheaper way

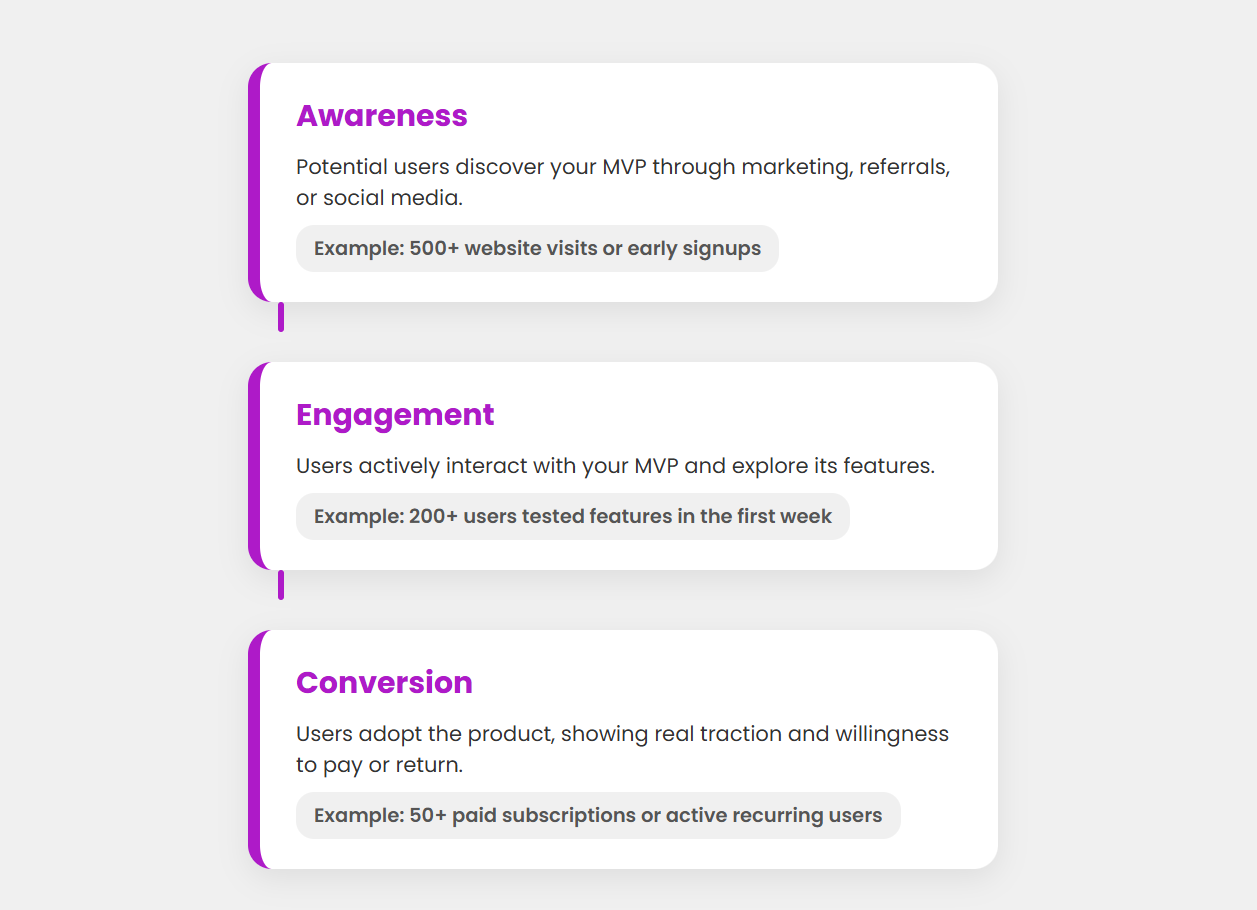

2. Measurable Early Traction (Your MVP Should Whisper “Demand”)

Investors like stories, but they LOVE numbers.

The difference between a deck and a pitch-ready startup is simple: Traction. Small or big, it counts. Even early numbers show that your product is solving a real problem, which is why it’s important to build a minimum viable product (MVP) that validates your idea before scaling.

These are some types of traction that impress investors:

- 200 – 1,000 early signups

- A waiting list conversion rate above 25%

- 10 – 20 daily active users

- Strong retention in the first 7- 14 days

- A growing TikTok or Instagram community

3. Simplicity in User Flow (Investors Want Momentum, No Complexity)

If a user gets confused, investors get concerned. At this point, you don’t necessarily need animations, dashboards, or a 12-step onboarding for your MVP for fundraising. All you need is a smooth and intuitive path from A to B. And that guides the investor’s expectations in MVP usability:

- One core user journey

- No distractions

- No dead ends

- Clear call-to-actions

- Fast load times

A clean flow communicates maturity. It tells investors you have done the homework.

4. Evidence of Revenue Potential (Even If You Haven’t Monetized Yet)

Seed-stage investors know you may not be making money yet. But they still want signals that you can. Even one tiny revenue signal is worth gold.

A strong pitch-ready startup shows one or more:

- People willing to pre-pay

- People are joining a waitlist for premium features

- Users asking for paid upgrades

- Interest from partnerships or early B2B leads

Zappos didn’t code a platform. Nick Swinmurn validated demand by taking shoe photos and buying them manually.

That’s a perfect example of an investor-ready MVP: simple, scrappy, validated.

5. Data That Shows Retention, Not Just Acquisition

Many founders overlook retention because it’s hard, but investors don’t. Glencoyne’s benchmarking data shows that at the seed stage, investors often look for logo retention above 80% and Net Revenue Retention over 100% to feel confident in long-term value.

That’s because retention is the heartbeat of a real business. Your MVP for fundraising should be able to show:

- Who keeps coming back, and why?

- How often do users return?

- What actions do they repeat most?

- Which feature drives the strongest engagement?

6. Fast Feedback Loops (Investors Love Founders Who Learn Fast)

Your MVP is a learning machine. Seed investors don’t just bet on ideas; they bet on founders who can adapt and iterate fast.

A strong founder releases, tests, learns, and improves rapidly, even before the product feels “perfect.” That speed often matters more than product completeness. Incorporating user feedback in MVP validation is important as it shows you are actually solving problems for real users, rather than just building.

This is what makes a feedback loop “Investor-Grade”:

- Weekly user interviews. Hear what real users really want

- Quick iterations. Act on feedback without delay

- Measurable changes. Show data-driven improvement

- Documented learnings. Make insights visible and repeatable

- Clear product evolution. Demonstrate progress over time

7. A Vision Beyond the MVP (Show Growth, Not Just Launch)

Your MVP is just the first chapter, not the whole story. Seed investors aren’t looking for perfection today; they’re looking for future potential.

They want a clear roadmap from MVP → Version 1 → Scale, and they invest in founders who can connect the dots between what exists and what’s next. A pitch-ready startup communicates:

- What you’ve learned so far from real users

- What will you build next to improve the product

- Which features drive future revenue

- Where product-market fit might emerge

7 Steps to Build a Fundraising Ready MVP

This is a simple and realistic plan you can follow to build an MVP that’s actually attractive to investors:

1. Validate the Problem First, Not the Product

This is the most important step when you are building an MVP as a non-tech founder. Before you write a single line of code, make sure you talk to people who might actually use your idea to understand their pain points. Ask them about their pain points, not how cool your app could be.

2. Build Only the Core Workflow

Keep your MVP lean. Focus only on the absolute must-have feature(s) that solve the core problem.

Joel Gascoigne started with a very simple two-page website for Buffer. One page explained the idea (“schedule your tweets”), and the second was a pricing page with fake plans. He hadn’t built the scheduling system yet, he just wanted to see if people would pay.

After people signed up and clicked on the pricing, he started building the actual product.

3. Test with Real People, Not Just Friends

Get 20–50 real users (or more) who represent your target customers. Let them try your MVP, even if it’s not “finished.” Then record everything: how they use it, where they get stuck, and what they value.

Instead of building the entire sync system first, Drew Houston made a simple 3‑minute demo video showing how Dropbox would work. He shared it on Hacker News and collected thousands of emails on a waitlist.

That demo helped him validate that people really cared about seamless file syncing, without building the whole infrastructure.

4. Measure Retention and Engagement, Not Just Sign‑Ups

It’s not enough to get people to sign up. Investors care about who comes back and why. Track things like:

- How many users return

- How often they come back

- What feature they use the most

When people consistently come back, it means your MVP is solving something real.

5. Iterate Quickly Based on Feedback

Use the feedback from your real users and move fast. Make small changes, test again, and repeat. This is what you should do:

- Do weekly user interviews or feedback sessions

- Push out small updates regularly

- Track whether changes improve engagement or retention

This shows investors that you are learning and improving, alongside building.

6. Put Your Learning in Your Pitch Deck

When you talk to investors, don’t just present slides about future plans; show what you’ve already learned from real users. Add:

- Data on how many people used your MVP

- Feedback (good and bad) from your users

- What you changed based on that feedback

That makes your pitch-ready startup feel much more credible.

7. Lay Out Clear Next Steps

Investors want to see more than your MVP. They need a roadmap: where you go from here. Explain:

- What do you plan to build next

- Which features will drive revenue or retention

- How do you think the product will scale

This is how you transform your idea into an MVP for fundraising and build a true pitch-ready startup that investors say yes to.

Final Note!

Building a fundraising-ready MVP is hard. Founders often wrestle with questions like whether they are solving the right problem, which features to actually build, how to get real users without spending a fortune, and what will make investors trust them before the product is even fully built.

These doubts can keep you up at night, replaying your pitch deck and second-guessing every decision.

Doerz Tech works alongside you to validate your idea before you spend months coding, define the core features that truly solve your users’ pain, and test with real people to generate actionable insights.

At the end of the day, you need to show investors that you understand the problem, validate the solution, and can execute. That’s exactly what a partnership with Doerz Tech helps you achieve an investor-ready MVP from just an idea.